Incoterms 2021

What are incoterms?

Incoterms the standard contract terms used in sales contracts to define responsibility and liability for shipment of the goods when doing import/export.

Why is it important?

It is important to familiarize yourself with the details of each Incoterm for both sellers and buyers, so that they can choose the one that makes sense for their global shipment. Incoterms help both sides to ensure that the goods are delivered safely and efficiently.

What is the importance of incoterms when quoting?

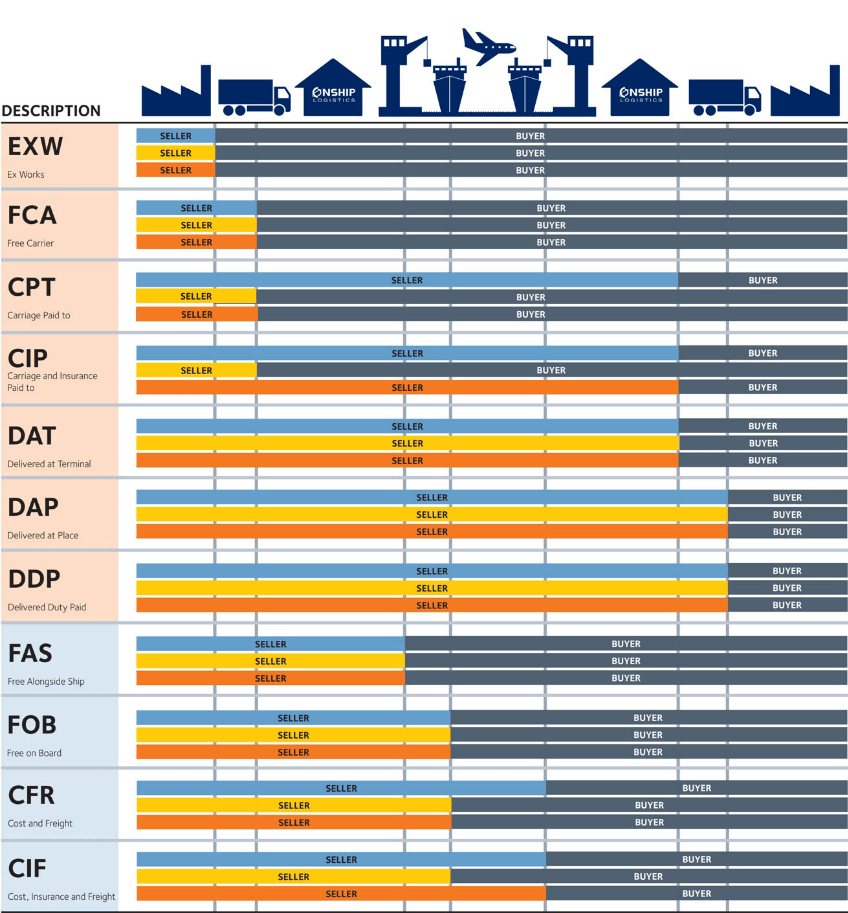

Incoterms can also be sorted into 4 groups:

- E type (EXW): The seller bears little cost and responsibility.

- F type (FOB, FCA, FAS): The seller is responsible for transporting the goods to the buyer’s predefined transport medium, and then the buyer assumes all responsibilities from that point onwards.

- C type (CFR, CIF, CPT, CIP): The seller bears all costs and responsibility to the destination port. Then the risks are transferred to the buyers once the goods are loaded on the means of transport.

- D type (DDP, DAP): The seller bears maximum responsibility for cost and risks.

Moving from incoterm group E to D, the buyer’s risk, and responsibility

decreases while the seller’s risk and responsibility and control increases.

Most incoterms apply to both air and sea freight, only the incoterms below are suitable for sea and inland waterway transport:

- FAS (Free Alongside Ship)

- FOB (Free on Board)

- CFR (Cost and Freight)

- CIF (Cost, Insurance, and Freight)

What other things you need to know for Incoterms?

Main Differences are Specific to a Country

The US is the only country that requires a Customs Bond. To import into the UK, they require a Deferment Account, and for export from India, it includes a withholding tax.

What Shipping Incoterms Don’t Cover

Incoterms do not cover property rights, possible force majeure situations and breach of contract. Similarly, all incoterms except the C terms do not assign responsibility for arranging insurance.

Cargo insurance is, therefore, a separate cost for buyers.

Define Named Place in the Sales Contract

When the incoterm is written in the sales contract, the named place should immediately follow the three letter incoterm abbreviation. For example “FCA Shenzhen Yantian CFS.” Be precise when defining the location, as large cities may have several terminals with several dropoff points. Use this global port finder to find specific port codes!

Below are the top 5 FAQs that are frequently asked by our clients regarding global shipping!

Click the link below and get an instant estimate of your freight shipping costs now!

Get my estimated freight cost now

Find out what is the right incoterms that is suitable for your business! Our next article will be exploring more about each incoterms. Stay tuned to find out more about incoterms!

PanPages Trinity Sdn. Bhd. (1258898 - M)

Selangor Office: A-03-01, Block A, Sunway Geo Avenue, Jalan Lagoon Selatan, 47500 Bandar Sunway, Selangor

Penang Office: 01-02-15, Terrace Plus, Tingkat Mahsuri 5, 11950 Bayan Baru, Penang

Privacy Policy

All Rights Reserved | PanPages Trinity Sdn Bhd

Designed by Trinity42