PanPages Trinity Export Ecosystem Partners

PanPages Trinity is now an official partner with Sealnet, China Construction Bank Malaysia and Alliance Bank!

This partnership marks another milestone for PanPages Trinity to bring Malaysian SMEs to the world through export solutions and strategies. An effort by 4 parties to help grow & expand businesses to the next level. Needless to say, we understand the issues faced by export businesses out there. Therefore, we’ve created an end-to-end export solution to assist businesses in all aspects!

What is PanPages Trinity Export Ecosystem?

PanPages Trinity’s ecosystem involves groups of largely independent economic players that create products or services that together constitute a coherent export solution to help business export globally.

How Does Our Partnership Help Your SME Business?

- Sealnet

Sealnet is a logistics solutions provider company which provides one-stop logistics solutions and cross border cloud services to importers, exporters, manufacturers and trade-related businesses. They help businesses to increase efficiency with their latest integrated trade facilitation web solutions. They aim to help businesses eliminate the chance of errors during logistics and allow businesses to track their goods and trade documents that can be accessed anytime, anywhere, in real-time.

With SealNet, businesses can save costs from printing documents & physical product storage. At the same time, it also helps businesses gather information from multiple vendors and extract on-site information manually. This is a time-saving solution as the SealNet system is able to populate data in the system automatically, which enables businesses to handle more jobs due to lower turnaround time. Furthermore, the data has a re-usability feature for future use.

Adding to this list of features, the system also provides a document verification process, visibility and end-to-end tracking. A digital report is also downloadable together with statistical analysis based on big data to allow quick business decisions to be made.

The SealNet system itself provides advanced technologies such as cloud, IoT, AI and blockchain to secure your data and protect your documents in the system. It has good mobility with multiple access for decision-makers in the business. To top it all off, this system has advanced compliance in place which is technology-driven.

2. China Construction Bank (Malaysia) Berhad

Our other partner is China Construction Bank (Malaysia) Berhad.

Their platform, "CCB Match Plus" is a smart matchmaking platform owned by CCB Corp to assist the platform users to look for business opportunities around the world. On the "CCB Match Plus" platform, CCB Corp acts as a third-party service provider connecting online and offline channels, domestic and overseas markets, and internal and external systems. The platform provides smart matchmaking solutions for parties with cross-border needs. In response to information asymmetry in cross border scenarios, the Platform utilizes big data and understanding of corporate needs to achieve data mining and precise matching.

The Platform also provides a full range of professional financial services including accounts, settlements, credit facilities, fund custody, guarantee and risk management. Through sharing data, channels and resources, the Platform has created internet-based information plus within a financial services ecosystem, in order to enhance the accuracy and timeliness of transactions, to improve the availability of funding, lower financing costs, and contribute to the optimization and upgrade of industries and the digital transformation of the traditional economy.

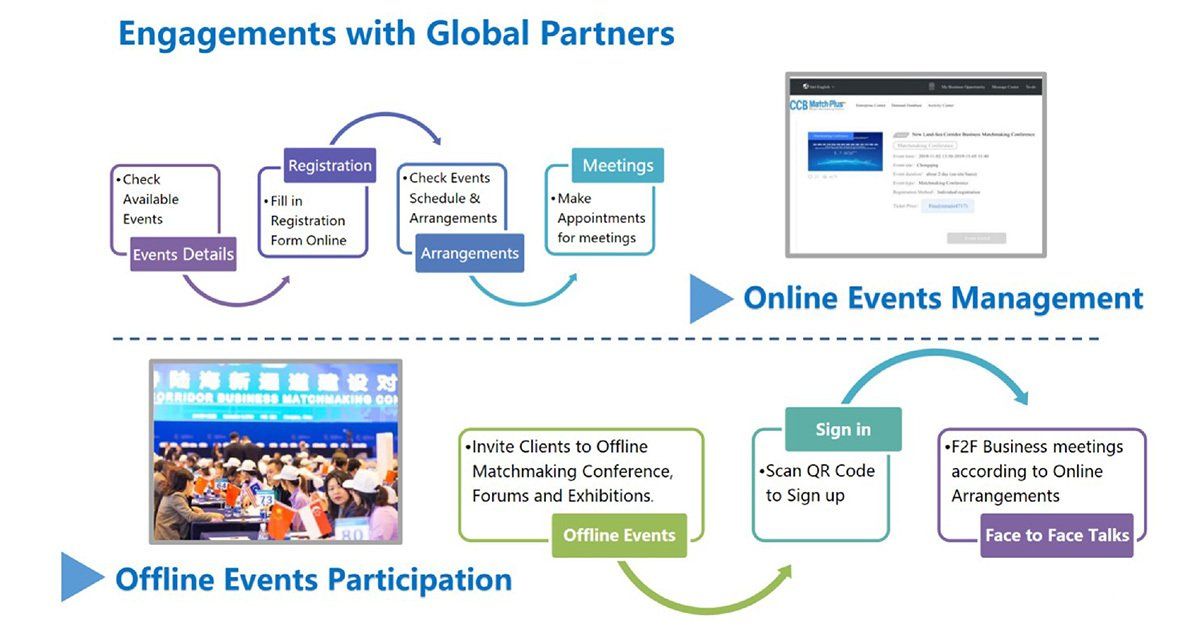

How To Make Online And Offline Matchmaking Events Work?

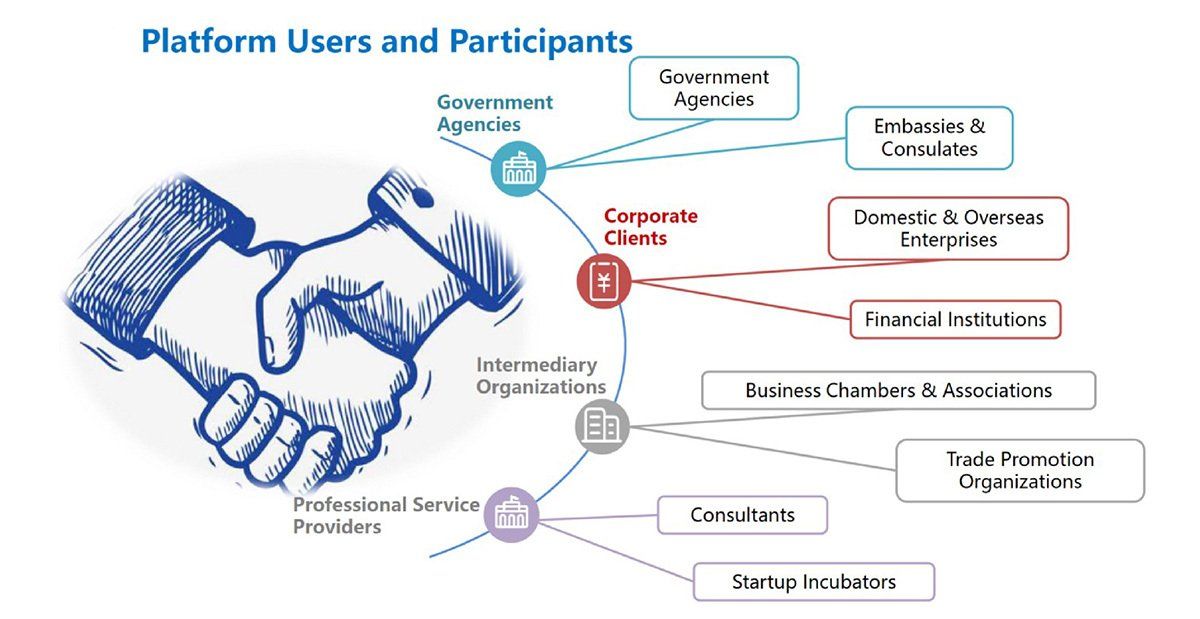

Who Are The Platform Users And Participants?

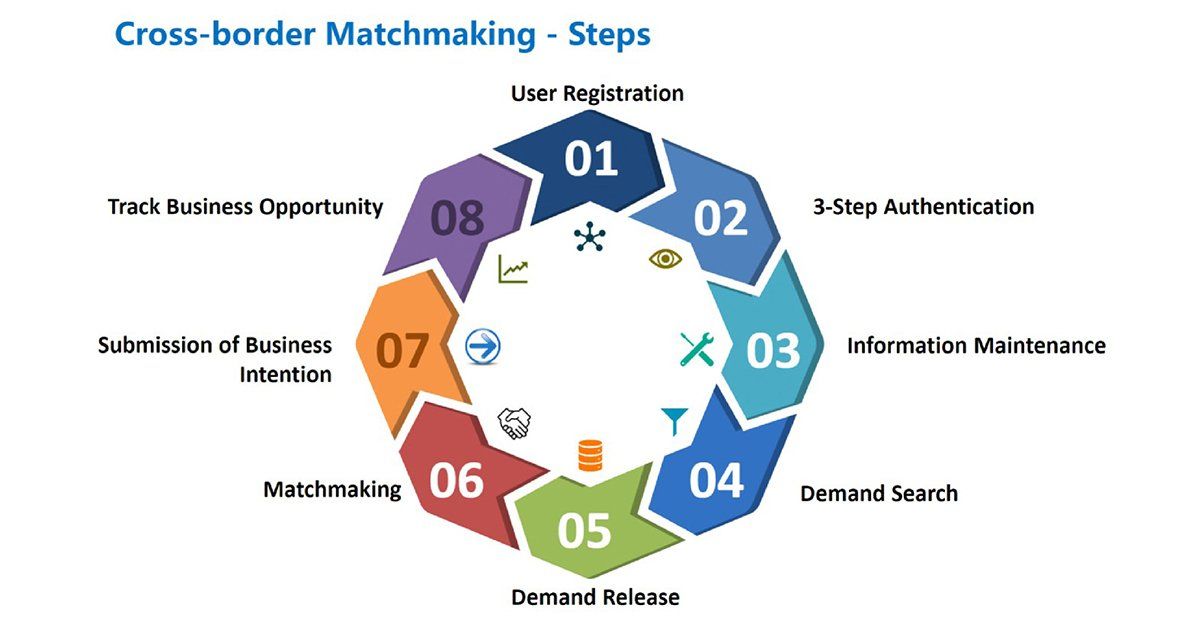

What Are The Steps To Be Part Of The Cross-Border Matchmaking Platform?

3. Alliance Bank

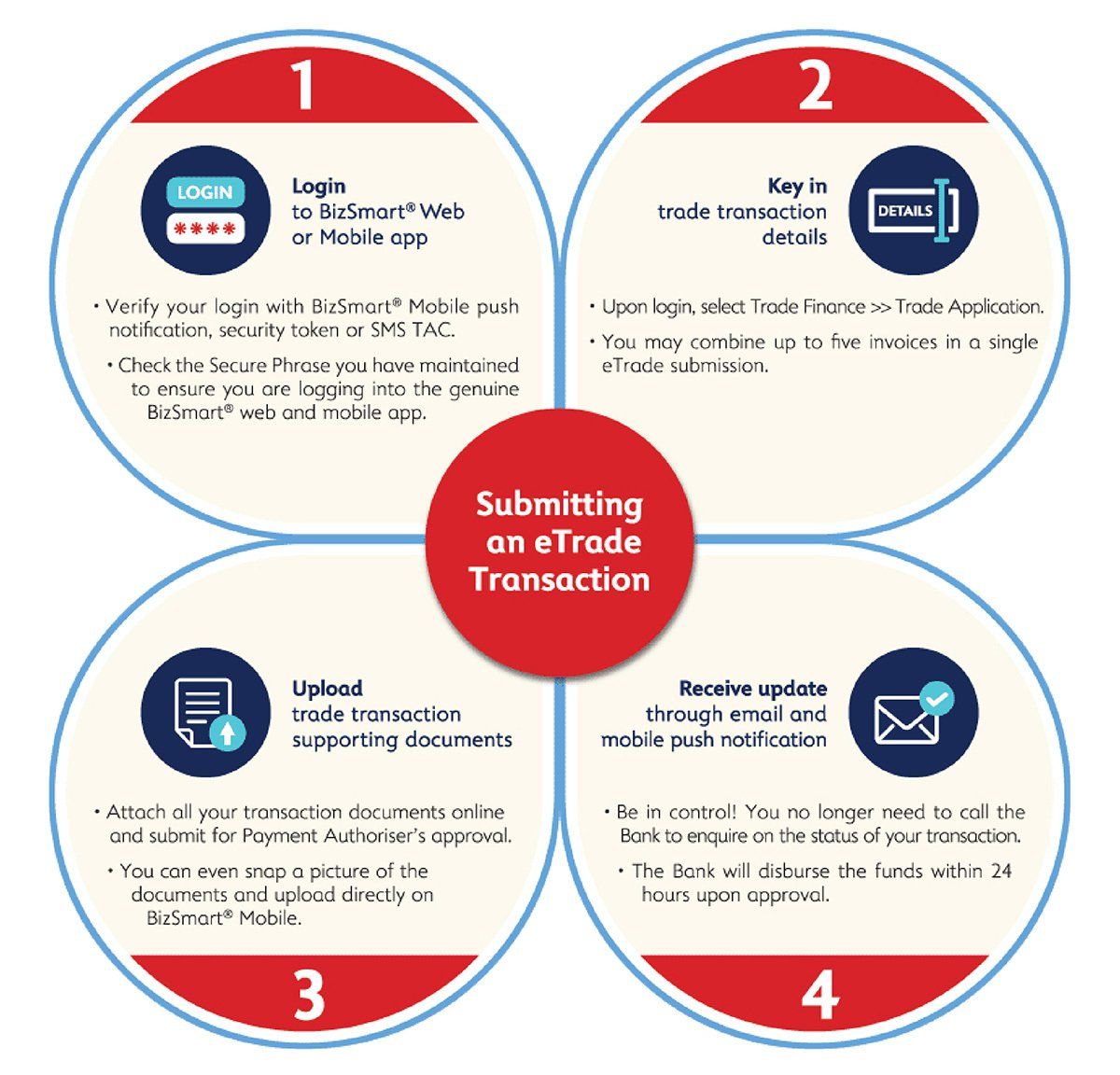

Alliance Bank offers 3 main elements in their export ecosystem to support Malaysian businesses financially. Alliance BizSmart® eTrade is a Trade application service provided via Alliance BizSmart® Online Banking and Alliance BizSmart® Mobile. It focuses on growing your business more efficiently with less paperwork, and also allows businesses to submit trade transactions online, anytime and anywhere.

What Are The Benefits Of Using BizSmart® eTrade?

With BizSmart solution, you can submit your trade application and upload your supporting documents online, anytime, anywhere, without any doubt. The system also provides same-day approval for transactions submitted before 12 noon, and your approved trade proceeds will be credited into Alliance account within 24 hours of approval. This solution helps you to save time and effort on submitting documentation & tracks transaction documents & recordings, you can track the status of your applications easily through your phone.

In addition, the Bank offers a range of financing which suits your business needs, including financial support for business expansion, easing your cash flow, financing your invoice and working capital, etc. Furthermore, BizSmart Solutions also includes a marketing platform that helps businesses to feature their products in the local market, adding on to CCB MatchPlus and Alibaba which help you to market your product internationally. In this case, you can have extra opportunities to expand your business and get your business to list on the BizSmart Solution Portal for FREE!

If you would like to know more about our export ecosystem, & how our partner’ services can help you with getting more business opportunities in order to grow your business to the next level. Click

here